SAUDI ARABIA

Blooming Entrepreneurship

articles & interviews

Introduction

Blooming Entrepreneurship

Technology

Young entrepreneurs take the tech world by storm

Urban Development

Becoming a leader in urban modernization

National Champions

Shining stars of the new industrial ecosystem

Aviation

Revamping the transport sector

Energy Transition

Steps up as a world leader in the green energy revolution

Healthcare

Health care is going native

Made in Saudi

Unlocking value from local manufacturing

Ajlan & Bros Holding Company

Saudi Arabia invites global participation

Al Othaim

Aligned with the National Quality of Life Program

Ma'aden

Saudi Arabia sets its sights on minerals

Tamer Group

Business innovation drives cultural change in Saudi Arabia

The Helicopter Company

Saudi Arabia’s first commercial helicopter operator sees vertical lift off

Arabian Oud

Perfume frontrunner brings Saudi traditions beyond borders

Go Energy Group

Forward moving with a green heart

Tamara

Fintech front runner

Interviews

Blooming Entrepreneurship

Saudi Arabia’s economy is growing rapidly. Its gross domestic product rising by 8.7% in 2022, making it the fastest growing economy in G20 countries. The country is now outpacing global giants China, India, Indonesia, South Korea and Taiwan as international markets are hit hard with higher energy prices and a shake up of value chains. While Saudi Arabia’s growth is largely funded through its oil operations, the country’s giant diversification program meant to reboot the country as a vibrant industrial powerhouse is bearing fruit. In Q1 2023, non-oil activities grew by 5.4% compared to growth of only 1.4% in oil activities. The country is using this new momentum to not only fuel its nascent mining, tourism, medical, entertainment, tech, renewables and logistics sectors, but also transforming the local business mindset towards that of entrepreneurialism and innovative thinking. The nation is actively promoting its new success in global markets to attract participation from foreign investors, including recently making a bid to host the 2030 World Expo.

-

read more...

Launched in 2016, Vision 2030 is the country’s flagship vehicle for industrial transformation. Under the initiative, the country aims to attract 100 million visitors annually, put three of its cities in the 100 top-ranked cities in the world, have at least five of its universities in the top 200 global universities and increase the contribution of small and medium-sized enterprises to 35%. The nation is already far outpacing its targets under the program. In 2022, Saudi Arabia achieved a localization rate of 59.5% in its oil and gas sector, surpassing its targeted baseline of 37%. New jobs created under the program have had a significant impact on lowering unemployment rates in the country, with rates falling to 8% in Q4 2022 compared to 11% the year prior. The percentage of university graduates joining the labor market within six months of graduation reached 32% in 2022 against a set target of 13.3%. Additionally, reforms under the program have empowered women, with their participation in the labor market doubling since 2016 to reach 34% in 2022 and surpassing a set target of 22.8%. Tourism, a key vertical in the program, saw 94 million tourists traveling in the market in 2022. The segment saw growth of 121% in 2022, making it the fastest growing tourism sector among G20 countries. The Vision 2030 program is also pushing for sustainability under its Saudi Green Initiative and the Middle East Green Initiative, with around 50 billion trees planted and 200 million hectares of degraded land reclaimed in 2022 with the larger goal of achieving net-zero carbon emissions by 2060.

Saudi Arabian business leaders are taking advantage of the liberalized market to innovate and create new pathways with a renewed can-do attitude. “The Saudi Arabian government is currently keen on progressing industrial development very quickly. Our challenge as private companies is to be even faster,” said Sheikh Mohammed Alajlan, vice chairman of family-owned conglomerate Ajlan & Bros Holding Company. The company is making headway in a multitude of sectors, including creating partnerships in information technology, renewables, digital banking, defense and marine services. “Under Vision 2030, the government is now supporting the private sector and giving us tools that we did not have before,” said Meshaal Bin Omairh, Group CEO of Abdullah Al Othaim Investment Company. The company is heavily aligned with Vision 2030’s goal to make Saudi Arabia an entertainment hotspot through its commercial malls and cinemas. Another leading player is Saudi Arabian Mining Company or Ma’aden that is looking to create a substantial minerals sector in the country by partnering with companies from across the globe. “We have to do things in the sector that have never been done before,” said Robert Wilt, CEO of Ma’aden. “Our aim is to be a role model in environment, social and corporate governance activities.”

Technology

Young entrepreneurs take the tech world by storm

Saudi Arabia’s path to modernization is putting youth at the forefront under its Vision 2030 initiative. The number of residents under the age of 35 is significant, making up 63% of the country’s population of 32.2 million. To support this demographic, the government has committed to creating 200,000 jobs by 2025 through entrepreneurship. Under the Vision 2030 initiative, Saudi Arabia aims to have small and medium-sized enterprises (SMEs) account for 35% of its gross domestic product by 2030. The nation is also currently pushing growth of its nascent technology sectors through its National Strategy for Digital Transformation, which has enabled the creation of digital regulatory sandboxes. The most active of these was created by the Saudi Central Bank in 2018 to catapult digital startups in the financial sector. Since it was launched, the number of local fintech startups have grown by a compound annual growth rate of 147%, with more than 550 fintech entities expected by 2030. The Vision 2030 strategy also envisions a sizable artificial intelligence sector that is targeted to be valued at $135.2 billion and contribute 12.4% of the country’s gross domestic product by 2030.

Saudi Arabia’s startup and funding landscape is a major economic spark in an otherwise depressed global venture capital landscape. There can be no better time to have a good idea in the kingdom, particularly in tech.

In 2022, Saudi Arabia saw $1.2 billion in funding handed to startups, the second highest in the region following the UAE. Fintech startups attracted the most attention, with four out of the top ten funded companies working in the sector. Between 2018 and 2022, Saudi Arabia’s venture capital ecosystem saw a compound annual growth rate of 74%. At the LEAP 2023 tech conference in Riyadh in February 2023, a plethora of investment funds and initiatives were announced worth $2.8 billion to promote technology startups from all corners of the market. These included local banks Banque Saudi Fransi and Riyad Bank committing $1 billion each and Merak Capital committing $53 million to support growth of the information and communications technology sector; local asset manager Impact46 contributing $133 million to fund startups in the Middle East and North African region; Abu-Dhabi-based investment firm Shorooq Partners pledging $100 million to create a venture debt fund, with $15 million being put towards Saudi Arabia’s first gaming accelerator fund; Saudi Investment Bank announcing it would dedicate $40 million towards developing fintech; venture capitalist fund Planetary Capital pledging $30 million to the space technology sector; and fellow venture capitalists entity Rakeezah Ventures committing $25 million to build an accelerator-backed funding program. The Saudi Unicorns Program was also announced at the conference, which aims to drive the value of its initial 34 companies to above $1 billion each.

-

read more...

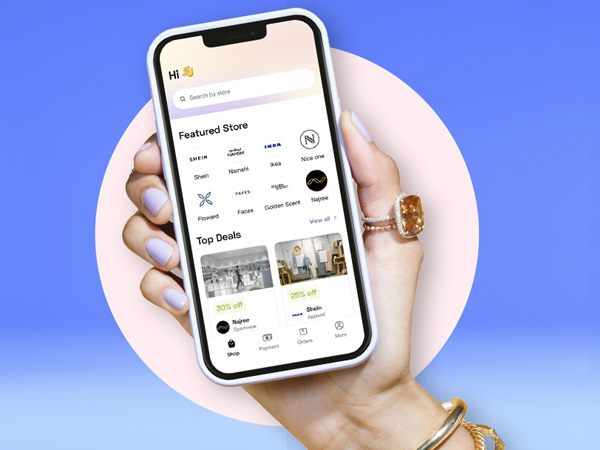

Saudi Arabia’s recent mass funding of SMEs is already bearing fruit. Tamara, which provides a buy-now-pay-later platform has rocketed to regional acclaim since it was established in 2020, with now more than 3 million customers and more than 4,000 merchants including international brands such as IKEA and Adidas and regional online shopping platforms such as Namshi and Jarir. The local company was the first buy-now-pay-later platform to utilize the Saudi Central Banks’s digital sandbox. Within the first five months after launching, the company passed multiple regional funding milestones, including the largest-ever initial seed investment round in Saudi Arabia with $6 million raised and the largest-ever recorded Series A funding round in the Middle East and North African region with $110 million raised led by fintech leader Checkout.com. In 2022, the company underwent its Series B investment round, bringing up its total acquired investment to $216 million. “The proof of our success lies in the trust we now have from international players such as Checkout.com, Goldman Sachs and Coatue that have recognized our potential and value,” said Abdulmajeed Alsukhan, co-founder and CEO of Tamara.

“The proof of our success lies in the trust we now have from international players that have recognized our potential and value.”

Abdulmajeed Al Sukhan

Further assisting investors with their goals is Endeavor Saudi Arabia, which commits to supporting businesses over the long term, including scaling up and connecting business startups with investors in Saudi Arabia. A rigorous process ensures that only the best succeed in partnering with Endeavor; typically, one out of 30 applicant companies receive an initial review. Saudi Venture Capital confirmed its investment of $7.5 million in Endeavor Global in May 2023 to fuel the growth of startups and SMEs in the country.

“One entrepreneur can positively influence more than 600 startups through mentorship, spin-offs or angel investment,” said Lateefa Al Walan, managing director of Endeavor Saudi. “Typically, out of all registered SMEs, only 2% are high growth, yet they account for 50-60% of the jobs created by SMEs. This is why high-impact entrepreneurship is so critical.”Founded in 2006, Unifonic is a local pioneer in communications through its unique customer engagement platform. The company now has 500 employees and more than 5,000 business accounts, including leading local banks and government entities. The company now handles more than 10 billion transactions per year in more than 160 countries. In October 2022, the company purchased Sestek, a Turkish company specializing in conversational artificial intelligence, to better serve customers. In April 2023, the company partnered with InspireU, Saudi Arabia’s first corporate accelerator, to promote local endeavors in information and communication technology, fintech, cybersecurity and digital innovation. “We have the support of the leadership to be different; I think this is important for the culture,” said Ahmed Hamdan, CEO of Unifonic. “That mindset change is happening from the top level, and it will trickle down to everyone to solve the problems we face today.”

Learning from accelerator best practices from around the world, the country has launched various startup incubators. TAQADAM is the Middle East’s only multi-university startup accelerator. It is delivered by King Abdullah University of Science and Technology and provides a six-month initial accelerator program that allows participants access to the university’s research and development and infrastructure. In March 2023, TAQADAM awarded $1 million to 10 new participants. Launched in 2019, Misk Accelerator provides 10-week virtual programs for aspiring entrepreneurs. So far, the incubator has supported more than 130 companies and created more than 2,330 jobs. In March 2023, 20 companies graduated from its program. Another incubator, The Garage, was launched in February 2022. The startup support entity signed a partnership with Google for Startups in August 2022 to support more than 100 startups around the world.

“One entrepreneur can positively influence more than 600 startups through mentorship, spin-offs or angel investment.”

Lateefa Al Walan

Saudi Arabia’s technology sectors are also being supported by its highly performing students and talent, highlighting a change in generational values. In November 2022, the MiSK Global Forum took place in Riyadh under the theme of generational transformation, with 15,000 young people in attendance and people from 120 countries joining virtually. In 2022, 35 Saudi Arabian students from a pool of 1,800 youths from 80 countries received a total of 22 awards at the International Science and Engineering Fair in the United States and a group of Saudi Arabians also won 13 science and technology awards at ITEX, an innovation and invention hub in Malaysia. In June 2023, 120 university students joined the Saudi Arabia Innovation Summit 2023 organized by Schneider Electric for exclusive career coaching designed to create better job prospects and empower the country’s youth to become future leaders in science, technology, engineering and mathematics. The company took on 22 graduates in its Early Career Program in 2022, of whom two third were women. In 2023, the intake number increased to 150. “Youth in Saudi Arabia and the wider Middle East represent a dynamic and tech-savvy generation that is eager to embrace new opportunities,” said Alsukhan.

Movers & Shakers

Abdulmajeed Alsukhan

Co-Founder and CEO of Tamara

Leader in fintech sets example for Saudi Arabia

Abdulmajeed Alsukhan, Co-Founder and CEO, Tamara, discusses the rapidly changing landscape of Saudi Arabia’s digital finance ecosystem and the company’s rise as a regional leader in buy-now-pay-later (BNPL) platforms.

“The proof of our success lies in the trust we now have from international players that have recognized our potential and value.”

Abdulmajeed Alsukhan

-

read full interview... -

How has Saudi Arabia’s digital finance ecosystem developed in the last decade?

The financial services industry in Saudi Arabia is experiencing a rapid transformation with a focus on modernizing the payments infrastructure and driving economic growth. In 2022, the country recorded an impressive 352 million real-time payment transactions with projections of reaching 1.2 billion in 2027. Traditionally, the Middle East was cash-focused and credit penetration was limited. Credit card usage in the region was relatively low and alternative payment options were needed. Trust in the BNPL option has grown rapidly, with more than 50% of consumers in the Middle East, North Africa, Afghanistan and Pakistan region currently using BNPL platforms and 36% of merchants in the region offering BNPL options at checkout. Due to the thriving financial services industry and the country's digital transformation, there is significant international interest in the region. The impressive growth in real-time payments and the government's initiatives have positioned Saudi Arabia as an attractive market for global investors and banking institutions. Tamara, with its commitment to revolutionizing the financial landscape, is at the forefront of this high interest in the region from an international perspective.

-

Why has Tamara been so incredibly successful in offering its BNPL platform?

Every experience we have is a steppingstone that leads us to something bigger and more impactful. My previous experience with building the online shopping and delivery service Nana exposed me to the hurdles of our e-commerce ecosystem in terms of payments and credit. These gaps in the ecosystem inspired my co-founders and I to establish Tamara. The company’s competitiveness stems from addressing significant gaps in the market and meeting the financial needs of the region's youth. Our BNPL platform appeals to the region's consumers, especially the younger generation who seek freedom and flexibility. Tamara's platform also offers a credit option that is Sharia-compliant, which is highly sought after in the region and aligns with the cultural and religious preferences of the population. Our regional success is driven by the shift in trust towards e-commerce, higher smartphone penetration, heightened investment in financial inclusion, limited access to short-term credit and a large population of young consumers. Tamara is well-positioned to capitalize on these factors and continues to drive innovation and growth in shopping, payments and banking segments in the Middle East and North African region.

Tamara’s growth is heavily aligned Vision 2030. Revolutionizing the payment and banking landscape in the region falls under Saudi Arabia's economic transformation and diversification program. The Vision 2030 initiative emphasizes the development of a vibrant entrepreneurial ecosystem and the promotion of innovation in financial technology within the country. We work hand in hand with local government regulators such as the Saudi Central Bank to ensure we are aligned with national strategies and serve the best interests of our customers. The proof of our success lies in the trust we now have from international players such as Checkout.com, Goldman Sachs and Coatue that have recognized our potential and value. Their continued support and investment validate our growth trajectory and position as a leader in the industry. -

How does the company address challenges related to risk assessment when lending money?

Tamara takes the issue of accurate and fast risk assessment in the BNPL system very seriously. We have implemented a robust risk assessment framework that combines advanced algorithms, machine learning and data analytics to ensure responsible and seamless lending practices. Our sophisticated risk engine analyzes various factors such as customer creditworthiness, transaction history and behavioral patterns to make informed decisions when providing credit. We are committed to maintaining the highest standards to protect our customers and ensure the long-term sustainability of our business.

-

What strategy is Tamara currently utilizing to grow its base and continue expanding in the GCC region?

We recognize that expansion can occur in the two following ways: vertically and horizontally. Our primary focus for the next two years is to serve the significant needs of the GCC region. We aim to provide a comprehensive and seamless experience that addresses the diverse financial requirements of individuals and businesses by doubling down on our core verticals, namely shopping, payments and banking. Our goal is to become the go-to platform for all things related to these segments in the GCC region by leveraging our expertise and technology. Tamara is well-positioned to leverage the growing digital payments landscape in Saudi Arabia; the majority of payments are expected to be electronic in the coming years. The high adoption rate of mobile wallets in Saudi Arabia further amplifies Tamara's growth potential.

Tamara's ability to become a unicorn is evidenced by its growth, scalability and record of setting new milestones in the region. However, becoming a unicorn is not our singular goal; our mission is to empower people in the region and inspire a new wave of innovation and entrepreneurship. We believe that through determination, passion and relentless pursuit of excellence anyone can create transformative change. By building a successful BNPL platform, we are not only revolutionizing the way people shop, pay and bank but also demonstrating that homegrown companies from the region can compete on the global stage.

-

What role do Tamara’s international offices play in building up the company’s capabilities?

The best talent spans borders. While we operate across Saudi Arabia and the GCC region, our team is global with offices in Saudi Arabia, the UAE, Egypt, Germany and Vietnam. Our offices in Germany and Vietnam play a crucial role in our company's development, particularly when it comes to engineering and technology. We have been able to attract top international talent from these regions and bring diverse perspectives to our team. The international talent pool has been instrumental in driving our technological advancements and enabling us to build robust and innovative solutions for our customers.

-

What efforts has the company made to drive and support its human capacity?

Our human resources policy is centered around enabling our employees to thrive and contribute to our collective success. We believe in hiring the best talent from around the world who possess exceptional skills and a drive for innovation. Once on board, we give them the trust, autonomy and space to excel in their roles. We have built a culture of collaboration where diverse perspectives are valued and encouraged. We also embrace flexibility and understand the importance of work-life harmony, especially in today's dynamic work environment. Building a high-performance environment and unleashing the full potential of our employees is what has driven Tamara's growth and success.

-

What is your personal mission in driving entrepreneurial change in Saudi Arabia?

I do not believe in settling for the status quo. We all have the opportunity to drive change through our stories. My mission has always been to create movements and leave an impact by building things that outlast me. I am driven by the potential for empowering youth in our region when it comes to payments and financial freedom. Youth in Saudi Arabia and the wider Middle East represent a dynamic and tech-savvy generation that is eager to embrace new opportunities. By providing innovative pathways we can enable them to have greater access to products and services they need while also promoting responsible financial behavior.

-

How has Saudi Arabia’s digital finance ecosystem developed in the last decade?

Lateefa Al Walan

Managing Director of Endeavor Saudi

The Multiplier Effect

With the belief that high-impact entrepreneurs transform economies, Endeavor mentors and invests in innovative companies, connecting them to the global network. Managing Director Lateefa Al Walan explains the strategy behind fostering a business community that "pays it forward." - Original

“One entrepreneur can positively influence more than 600 startups through mentorship, spin-offs or angel investment.”

Lateefa Al Walan

-

read full interview... -

Endeavor Saudi was created 10 years ago and is now a leading community of high-impact entrepreneurs.

How would you describe the way you work?At Endeavor, we meticulously evaluate entrepreneurs to ensure they are at an optimal growth stage, having achieved a substantial product-market fit and have a clear path to growth. Once they join our global network, we offer tailored services and resources to foster their targeted growth.

As a non-profit organization, Endeavor believes that cultivating a high-impact business is a marathon, not a sprint. Our unwavering commitment is to support entrepreneurs through mentorship and expert access, connecting them with peers in Silicon Valley, Latin America, and Southeast Asia via our extensive global network.

Endeavor is a safe haven for high-impact entrepreneurs worldwide, particularly those in the tech sector who may have exhausted local resources and mentorship opportunities. We bridge the gap by providing access to global expertise and experiences, thereby empowering entrepreneurs to thrive.

Our mission transcends merely facilitating startup growth and wealth creation. We also encourage entrepreneurs to become mentors and ecosystem supporters through Endeavor's "Pay it Forward" platform. Our board members actively support Endeavor's cause and contribute to our operations. We take pride in the diverse representation of successful Saudi entrepreneurs on our board, as we strive to foster a robust entrepreneurial ecosystem in Saudi Arabia.

An intriguing fact to note is that in the last 5 years , we have witnessed a growing influx of global entrepreneurs seeking assistance in entering the Saudi market. This trend highlights a growing entrepreneurial migration into Saudi Arabia, showcasing the nation's increasing appeal as a hub for high-impact businesses. -

According to the Small and Medium Enterprises General Authority (Monsha'at), there was a whopping 10% growth in a single 2022 quarter of SMEs registered in the kingdom.

What are the bases for this boom in entrepreneurship?It's crucial to distinguish between SMEs and pure entrepreneurship. Entrepreneurial companies are typically innovative, disruptive, and high-growth, whereas SMEs might simply be small businesses, such as laundromats. At Endeavor, our focus is on empowering innovative, high-impact enterprises.

Historically, starting a business in Saudi Arabia was not an attractive endeavor. Graduates aspired to secure steady government jobs or positions at large corporations like SABIC and ARAMCO. The entrepreneurial movement in Saudi began modestly around 2005 with families encouraging their children to explore trade or business careers. At that time, around 70% of Saudis worked for the government. Today, the landscape has shifted significantly, aligning with Vision 2030's goal of diversifying away from oil and creating more non-government, non-oil-dependent jobs.

Previously, there was no dedicated authority like Monsha'at to support SMEs. The private sector and the Chamber of Commerce drove these initiatives, but the agenda often got lost in the Ministry of Commerce. The establishment of a dedicated entity with the sole purpose of nurturing, taking action, and creating regulations for SMEs has been a driving force behind the growth we see now.

The advent of Monsha'at and the movement towards supporting SMEs led to increased access to capital. Programs like “Kafalah” and “Saudi Venture Capital” have had a significant impact on providing capital to SMEs by facilitating and guaranteeing loans through banks. This program has also enabled more capital for female-led businesses, resulting in a dramatic increase in the number of businesses owned or co-owned by women.

The Misk Foundation and Monsha'at have successfully shifted mindsets by launching initiatives that empower the youth to start businesses in KSA.

Endeavor's mission, conceived a decade ago when the term "entrepreneur" was not widely known, is to develop an ecosystem that supports and scales high-impact entrepreneurs. Typically out of all registered SMEs, only 2% are high-growth, yet they account for 50-60% of the jobs created by SMEs. This is why high-impact entrepreneurship is so critical.

In Saudi Arabia, large contributors to the ecosystem are abundant. Our focus remains on identifying high-potential entities and directing support to ensure growth, with the vision that within 10-20 years, the ecosystem will be more self-sustained and self-dependent. Entrepreneurs will no longer require donations, government assistance, or help from large businesses to access capital, investment, talent, and mentorship.

At Endeavor, we champion the "Multiplier Effect," which emphasizes the exponential impact founders have when mentoring, investing in, and inspiring future entrepreneurs. Our CEO, Linda Rottenberg, famously said, "A unicorn that doesn't breed even more unicorns is an endangered species." Endeavor Insight's research shows that one entrepreneur can positively influence over 600 startups through mentorship, spin-offs, or angel investment.

By supporting early groups of entrepreneurs, driving them to pay it forward, and encouraging individuals who've shared in their growth to start their own businesses, we can effectively cultivate and expand the entrepreneurial ecosystem. We are beginning to see this impact unfold in Saudi Arabia. -

Are we then already seeing a new pattern of what is to do business in Saudi Arabia?

Absolutely! Let me illustrate this with the tech sector as an example, as it's often considered the birthplace of innovation. We conducted a comprehensive mapping of the Saudi tech sector over the past 25 years, comparing data from 2000 and 2021. Our map highlights the density of companies along with the magnitude of their impact, represented as bubbles. This impact was calculated based on factors such as investments, former employees launching new ventures, mentorship, and more.

Our research uncovered a remarkable "hockey stick" growth pattern that emerged five years ago. In fact, nearly 50% of the tech companies in Saudi were established within the last five years alone. This surge in new businesses has resulted in 90% of job creation within the tech sector, driven by companies that have successfully scaled. Hence, it's not just about being innovative, but also possessing the ability to scale effectively. For our analysis, we defined scaling as the capacity to grow beyond 50 employees. This evolution demonstrates a significant shift in the business landscape of Saudi Arabia, driven by forward-thinking entrepreneurs and a thriving tech sector. -

In your opinion, is Saudi talent culture evolving to work for growing startups?

Definitely, we are witnessing a notable transformation in the Saudi corporate landscape, with an increasing number of skilled individuals gravitating towards startups and growing tech companies. Talented professionals are now leaving established corporations and international firms to contribute to the growth of dynamic and innovative enterprises.

Take, for example, Ebrahim Al-Jassim, who successfully scaled HungerStation, one of the largest food delivery apps, which was eventually acquired by DeliveryHero. His executive team comprised experienced individuals from major telecom companies like Mobily and STC. The fact that these professionals willingly transitioned from prominent corporations to a burgeoning startup is both astounding and revealing. Such a career move would have been unthinkable 15 years ago.

This shift aligns with the business models prevalent in the USA and Europe, moving away from traditional family-owned enterprises towards diverse groups of founders collaborating to grow businesses together. This progressive approach empowers the entire ecosystem, creating opportunities for everyone, regardless of their background or connections. All that truly matters is talent, ambition, and the drive to turn one's vision into reality.

-

One of your instruments is the Endeavor Catalyst Fund to invest in the entrepreneurs you support.

In general, how available is venture capital for startups and SMEs in Saudi Arabia?Reflecting on my own experience when I launched "Yatooq" back in 2011-12, there were very few tech founders to learn from or relate to in the region. We had to rely on global success stories or local ones that managed to capture investors' interest.

However, the current landscape has shifted dramatically, with increased access to capital and a growing appetite for higher-risk investments, particularly in the tech sector. Prior to 2018, one could count the number of active VCs in Saudi or the region on their fingers. Yet, with the inception of initiatives like the Saudi Venture Capital Company, a ripple effect has been created, leading to over 20 flourishing VCs in a relatively short span of time.

The emergence of VCs in their second, third, or even fourth generation signals a maturing ecosystem, demonstrating that investing in these companies can yield tangible returns. Saudi-based funds are now closing their first cycles and initiating their second ones, making capital more accessible and enabling entrepreneurs to grow faster.

Interestingly, when one of our entrepreneurs sought to raise capital, international investors were hesitant to invest until a local investor showed faith in the venture. After two years of pitching to international investors, it was a local investor who finally wrote the check, subsequently attracting international investment as well. This highlights the increasing confidence in and support of the local entrepreneurial ecosystem. -

One of the objectives of Vision 2030 is to create the playing ground for the private sector to take over as the leading engine of the economy.

What would you say are the most relevant challenges ahead?The private sector undoubtedly has a crucial role to play in achieving Vision 2030's objectives, particularly through close collaboration with regulators to unlock potential in areas that may otherwise face restrictions. Innovative approaches can thrive in such an environment, as evidenced by the fintech sector and the sandbox initiative introduced by the Saudi central bank (SAMA). This collaboration between SAMA and the Saudi Capital Market Authority has enabled the growth of numerous fintech companies – from none to an impressive 150, with a goal of reaching 500 by 2025.

An interesting insight from our fintech and tech studies is that large corporations can act as breeding grounds for exceptional tech entrepreneurs, further emphasizing their role in Vision 2030. Major companies like Aramco and STC have already produced a number of successful tech entrepreneurs. By fostering innovation and supporting the growth of new ventures, the private sector can effectively contribute to the realization of Vision 2030's goals and help shape a more diverse and dynamic economy in Saudi Arabia. -

The international expansion of Saudi companies has traditionally been limited—with exceptions—to the GCC and the MENA regions.

Do you see Saudi companies competing in Western markets, and particularly in the US?It's true that the vast potential of the Saudi market often leads us to advise entrepreneurs to concentrate on capturing local opportunities first. However, as the ecosystem advances and more unicorns emerge, we expect to see the rise of what we call "global native companies." For instance, one of the entrepreneurs we're supporting from the very beginning is focused on building a global business – their mindset, solution design, and technology are all tailored for the international stage, as opposed to merely addressing local needs.

That being said, we are still in the early stages of this transition. As investors and VCs mature and accumulate experience, we anticipate increased capital flow and greater interconnectivity between markets. This evolution will undoubtedly pave the way for Saudi companies to expand their reach and compete effectively in Western markets, including the US.

-

Endeavor Saudi was created 10 years ago and is now a leading community of high-impact entrepreneurs.

Urban Development

Becoming a leader in urban modernization

Saudi cities are undergoing dramatic transformations characterized by multi-billion-dollar projects that address climate change mitigation and housing shortages while positioning the country as a pioneer in urban development

Huge changes are occurring in Saudi Arabia’s urban landscape. The Middle East’s second-largest economy is embarking on a series of ambitious urban projects to help redefine its identity, replacing the traditional with a cosmopolitan ethos and using innovative techniques to address ecological and economic challenges. The modernization initiative is keenly visible throughout the country, including through the much-touted new-build giga smart city projects such as NEOM, Qiddiya, the Red Sea Project and Roshn. However, huge transitions are also occurring in established centers such as Jeddah and Riyadh utilizing advanced technologies that are primed to metamorphose the country’s largest municipalities to raise the quality of life for its residents.

“Our initial public offering will be very soon. We have a strong stock market here in Saudi Arabia and we are seeing high interest from investors. Investing in AO is low risk. Investors are not only investing in one industry but seven.”

Gautam Sashittal

Saudi Arabia’s capital and largest city, Riyadh, is a major focus of this transformation. Chief among the municipality’s many projects is the King Abdullah Financial District (KAFD), the world’s largest real estate endeavor located in the northwest of the city that spans a gross floor area of 5 million square meters. The project features more than 5,000 residential units, 1 million square meters of office space, 220,000 square meters of retail and restaurant space, and 110,000 square meters dedicated to entertainment. The project has put a huge emphasis on sustainability, becoming the only LEED platinum certified mixed-use district in the world. KAFD also features work from some of the world’s most celebrated architects, such as Foster + Partners, Henning Larsen Architects and Gensler, with the aim of solidifying the country as a world leader in architectural creativity. Standing out amongst these buildings is Riyadh’s tallest skyscraper, the Public Investment Fund Tower, that looms at heights of 385 meters with 80 floors. The project has attracted private sector participation, with KAFD signing three new partnerships in March 2023 with Saudi fintech FOODICS for a digital payment platform for residents; Saudi Telecom Company for data exchange and promotion; and Altawahuj Entertainment to develop a family-oriented adventure park. “A new journey is starting because we have only built on around 40% of our landbank,” said Gautam Sashittal, CEO of KAFD. “We have a huge number of projects we are working on that will be rapidly progressing in the next two to three years.” According to Sashittal, there will be 100,000 people residing and working in the district with more than 70 restaurants and three hotels by the end of 2024.

-

read more...

In addition to this city-changing project, Riyadh is also working to combat climate change and beautify the city through its Green Riyadh project, which will see the planting of more than 7.5 million trees across the city and an expansion of per capita green space from 1.7 square meters to 28 square meters by 2030. The project’s green goals are further reflected in new transportation initiatives. Traffic jams are a daily problem in Riyadh, with 2018 data indicating that citizens were taking around 8.9 million car journeys per day. To make traveling easier and to bring down carbon emissions, the city is embarking on an ambitious subway project. The underground transport link will feature six lines extending 109 miles and servicing 85 stations. The system is a showcase of new technology, including automatic electrification, wi-fi services, LED lighting and surveillance cameras. In October 2022, French smart mobility company Alstom opened its regional office in Riyadh and is providing its predictive HealthHub maintenance platform to the Riyadh metro and other national logistics assets. In addition to bettering its public transportation options, the country hopes to raise the share of electric and hybrid cars in Riyadh to 30% by 2030. With the total number of cars in the capital expected to reach 3 million by that point, there is an expectation that 1 million eco-friendly cars will be found on the streets of the city by the beginning of the next decade.

“Our initial public offering will be very soon. We have a strong stock market here in Saudi Arabia and we are seeing high interest from investors. Investing in AO is low risk. Investors are not only investing in one industry but seven.”

Meshaal Bin Omairh

Big changes are also happening in Saudi Arabia’s second metropolis Jeddah. Under the eyes of the Jeddah Central Development Company, the $20-billion Jeddah Central project will occupy 2.2 million square miles of land in the western port city. The project will see the construction of 17,000 houses for citizens and more than 3,000 hotels and tourism sites. It is expected to add $12.5 billion to the country’s economy by 2030. The project is set to completely revamp Jeddah, adding an opera house, a sports stadium, an oceanarium and a sports stadium to the city in addition to restaurants, cafes and malls. The project also includes the redevelopment of the city’s 5.9-mile waterfront, which will include a promenade, a marina for local and international yachts and a 1.3-mile beach. Open spaces are important to the design of Jeddah Central, making up 40% of the project area. Phase one of the project is set for completion in 2027.

Nearly 85% of Saudi citizens live in urban areas, and this number is set to increase substantially with ever-increasing flows of expats into the country. In Riyadh alone, the population is set to double by 2030, reaching 15 million. The provision of affordable and accessible housing has featured heavily in the country’s Vision 2030 plans, making the creation of new housing an integral part of city projects. Success has already been seen on this front, with the percentage of owned housing units increasing from 59.9% in 2017 to 62% in 2020 – putting the country on target to meet its goal of achieving home ownership rates of 70% by 2030.

To facilitate this process, the Saudi Central Bank has changed the minimum downpayment required for property purchases from 30% to 5% of the purchase price. Mortgages are a relatively new concept for Saudi home buyers, and the government announced plans in 2018 to increase the number of banks offering home loans, with an eye towards doubling mortgage lending. Real estate is a critical part of the Saudi Arabian economy and contributes around 7% of its gross domestic product. It is linked to several other sectors and created 40,000 job opportunities in 2021 alone, with more expected as new developments continue. The government’s goal is to increase the sector’s contribution to the gross domestic product to 10% by 2030. To achieve this, Saudi Arabia will seek to create nearly 1.2 million new homes by 2030 to reach a target of 4.96 million houses necessary to meet growing housing demand.

Movers & Shakers

Meshaal Bin Omairh

Group CEO of Abdullah Al Othaim Investment Company

AO plans to go public

Meshaal Bin Omairh, Group CEO, Abdullah Al Othaim Investment Company, praises Saudi Arabia’s recent shift towards private sector participation and foreign direct investment while detailing the company’s plans to participate in the transformation of the country’s urban centers with its flagship mini-cities projects.

"The business environment in Saudi Arabia is positive. There are ample opportunities for foreign companies and investors to establish themselves in the country and contribute to its economic growth."

Meshaal Bin Omairh

-

read full interview... -

How has the Vision 2030 initiative changed the business

environment in Saudi Arabia?

Under Vision 2030, Saudi Arabia's government has taken significant steps to support the private sector. By providing access to new tools and resources, the government has enabled businesses to thrive in ways that were not possible before. One tangible example of this is the newfound access to international resources.

Thanks to this support from the government, the private sector is now attracting global investors who are eager to live and work in Saudi Arabia. This is a major shift from the past when Saudi Arabia's private sector struggled to attract foreign investment.

By opening to international investors, Saudi Arabia is creating new opportunities for growth and development. The private sector is poised to become an even more important driver of the country's economy in the years to come.

Overall, the government's commitment to supporting the private sector is a positive development for businesses and individuals alike. By providing access to the tools and resources that are needed to succeed, the government is helping to build a stronger and more prosperous Saudi Arabia. The Kingdom of Saudi Arabia has made significant strides in streamlining the process for visit, work, and business visas for foreign nationals. The government has taken a proactive approach to support the private sector, partnering with them to develop projects that will benefit the country as a whole. Additionally, the government has provided funding through initiatives such as the Tourism Development Fund, which has helped to boost the tourism industry in the region.

As a result of these efforts, the business environment in Saudi Arabia is positive. There are ample opportunities for foreign companies and investors to establish themselves in the country and contribute to its economic growth. The government has put in place policies that are designed to attract foreign investment, and it has also taken steps to simplify the process of setting up a business in the country.

Overall, the government's commitment to improving the business environment in Saudi Arabia is evident. Through its partnerships with the private sector and its funding initiatives, it has created an environment that is conducive to growth and development. As a result, Tourism development fund (TDF) announced that (TDF) has signed a cooperation agreement with Al-Othaim Investment Company to develop several tourist projects across the Kingdom. The signing ceremony was held recently in Riyadh. The projects aim to enhance the tourism sector in the country and promote its natural, cultural, and historical landmarks.

The agreement comes in line with the Saudi Vision 2030, which aims to increase the contribution of the tourism sector to the national economy by developing and diversifying its resources. The TDF seeks to support and finance tourism projects that contribute to creating job opportunities and encouraging local and foreign investments in the sector. This agreement expected to have a significant impact on the tourism industry in the Kingdom, and to attract more tourists from around the world to visit its unique destinations.

The prospects for foreign companies and investors looking to establish themselves in the country are bright.

We have the support of banking institutions on the debt side, and the government on the other. This combination is something not found anywhere else; we are in the right place at the right time. Things are changing; there is a change in the quality of business, a change in standards and a change in the government itself. The public sector processes everything quickly and have set themselves an example for the private sector to follow. We encourage investors to not be influenced by what they hear and to come to Saudi Arabia themselves and experience what is happening in the market. -

Can you give our readers an overview of AOIC’s current assets

and focus sectors?

AOIC is spread across seven sectors, including real estate, hospitality, cinemas, foodservice, fashion retail and malls. Currently the company has developed 12 shopping centers in Saudi Arabia, making it the second largest shopping mall operator in the country. It also operates more than 70 entertainment centers in five countries in the GCC and North Africa. The company has grown significantly recently, with 14% growth and earnings before interest, taxes, depreciation and amortization margin of 55% in 2022. We currently operate five cinemas and plan on ramping up to 9 cinemas under our current strategy before the end of 2023. We are developing the Konoz entertainment city in Riyadh, which encompasses 50,000 square meters of commercial office space, 20,000 square meters of commercial entertainment space and 135,000 square meters of residential space. We also contribute in terms of job creation. For example, the Konoz project in Riyadh will create 15,000 jobs and our development in Al Khobar will create 10,000 jobs. We are currently developing 26 projects across Saudi Arabia, with most of them tabled for completion by 2026.

Al Othaim Family started the business with the retail supermarket segment. We have the same values today as we did 43 years ago. Although we have changed our financial position, assets, business lines, knowledge and resources, these values are what have sustained the business. The company’s success has been a continual process, and we must look to the future. While we are family owned, we are not a family business but a corporation with its own corporate governance. This approach has made a real difference in the company’s performance. As a company we are also firm believers in partnerships. We cannot do it alone and require partners to achieve our vision. When choosing a partner, it is crucial they share our vision, values, standards and timeline. We have already partnered with several companies, such as international architecture firm Benoy. We are also a private sector partner to the Saudi government.

-

What kind of new strategy is the company employing to spearhead

its giant development plans?

What the company has right now is just the beginning; we are now working on our new strategic plan and what will happen beyond 2026. A substantial strategy should be built on the company’s strengths, weaknesses and opportunities it may have in the future. Al Othaim Investments’s strategy involves three elements: an independent strategy for each sector, an integration strategy between each of these and a consolidated strategy for the entire company. The implementation processes of these three elements is crucial. We need to ensure we are aligned and have the resources and human capacity in place to make sure our strategy is implemented. Our new strategy is split into the two following focus areas: 85% mix-use projects such as contained entertainment cities and 15% blue ocean project such as hotels, residences and offices. Our mandate is not limited to development in the Kingdom, and we are open to doing business anywhere. However, we currently require our full capacity to fulfill the needs of the Saudi Arabian market.

-

Given the company’s upcoming initial public offering, what

factors make AOIC an attractive entity for investment?

Investing in AOIC is low risk. Investors are not only investing in one industry but seven. As a rule, we work with low-risk projects. We work in real estate, and all the projects are 70% owned by us. We have strong assets and a net margin of 30%, which is something you cannot find anywhere. We are also in an industry that is cash driven. Additionally, new regulations regarding foreign investments have eased foreign participation the Saudi Arabian market. We are now in the process of working with the financial advisory to find the right time to re-submit our file. Our initial public offering will be very soon. We have a very good stock market here in Saudi Arabia and we are seeing high interest from investors. There is a lot of value in the Al Othaim family brand; we have been in business for 43 years and will continue to be in business forever.

-

How has the Vision 2030 initiative changed the business

environment in Saudi Arabia?

National Champions

Shining stars of the new industrial ecosystem

With Saudi Arabia’s economy diversifying and developing at a breakneck pace, local companies in a variety of sectors have risen up and become the shining stars of the country’s new industrial ecosystem.

In an economy built around oil, Saudi Arabia’s business landscape has long been dominated by a single company, Saudi Aramco. However, with government support and a newly inspired private sector, that is starting to change – and fast. Companies in various sectors are now being promoted as national champions, private corporations that are allowed to attain a position of dominance within a given sector in exchange for promoting the nation’s vital interests. These entities stand out in their sectors, enrich the country’s economy and employ forward-thinking strategies that are laying the groundwork for continued prosperity. Partnerships have been critical for the creation of these national champions. Government organizations are facilitating these increasing links between Saudi Arabian entities by building strong networks and raising investor confidence in local goods and services.

“We are continuously looking for any potential opportunities to explore, especially as we now know the LPG market will be open for investors.”

Abdulrahman Bin Sulaiman

One example of Saudi Arabia’s national champions is the National Gas and Industrialization Company (Gasco), which is diversifying the country’s energy mix through the marketing of liquified petroleum gas (LPG). “The developments happening in Saudi Arabia today offer people a significant opportunity,” said Abdulrahman Bin Sulaiman, CEO of Gasco. “It is the right time for both Saudis and non-Saudis to explore these opportunities.” The company recently saw a year-on-year revenue climb of 9.24% in 2022, with returns of $57 million. The company is readily following Saudi Arabia’s Vision 2030 platform by partnering with local players to raise value across its value chains. In October 2022, the company teamed up with local shipping and logistics company National Shipping Company of Saudi Arabia, also known as Bahri, to boost distribution of LPG throughout the country by setting up a joint entity. “We are continuously looking for any potential opportunities to explore, especially as we now know the LPG market will be open for investors,” said said Bin Sulaiman. “We have started looking beyond Saudi as well and started discussions with companies in the wider GCC area.”

-

read more...

Another significant driver of Saudi Arabia’s diversification strategy is Saudi Arabia Mining Company (Ma’aden), which was formed in 1997 with the aim of capitalizing upon Saudi’s mineral resources. The company leads the charge on one of Vision 2030’s main verticals, namely creating value from Saudi Arabia’s nascent mining sector. “Ma’aden and the Minister of Industry and Mineral Resources are currently determining if there is truly $1.3 trillion worth of mineral resources in the Kingdom. This amount could potentially attract the world's best exploration and mining companies,” said Robert Wilt, CEO of Ma’aden. The company is embarking on several projects in partnership with global players, including a greenfield phosphate complex and upping production at its Jabal Sayid South and Umm Ad Damar mines. “There is a vast exploration undertaking by the Kingdom focusing on phosphate, bauxite, copper, gold, nickel, zinc and uranium,” said Wilt. “We are looking to see what resources are economical and can be brought on stream quickly.”

Private companies are also taking advantage of Saudi Arabia’s newfound stance on supporting new verticals. The Helicopter Company is bringing change to the nation, this time in the form of a state-of-the-art helicopter fleet. The company plans to introduce a nationwide helicopter emergency medical platform alongside Saudi Red Crescent Authority. The company was formed in 2019 and has experienced huge growth, planning to expand its fleet to 58 airframes by 2025. “In the past two to three years, I have seen more exciting projects than I ever could have imagined. One cannot grow a country without a solid aviation sector, and we are excited to be part of new developments,” said Arnaud Martinez, CEO of The Helicopter Company.

“We have become the world’s second largest exporter of phosphates and now have the world’s lowest costing, fully integrated aluminum chain.”

Robert Wilt

Other examples include family-run mega-giants that are stepping into the spotlight as Saudi Arabia diversifies. Al Muhaidib Group is one of the largest private conglomerates in the country. The group works across a variety of sectors and has invested in a few champion companies, including local renewables powerhouse ACWA Power, as well as running Al Muhaidib Group Entertainment Ventures. The company recognizes the potential throughout Saudi Arabia and notes the importance of adapting company planning, particularly in Saudi Arabia’s rapidly changing industrial environment. “We are always re-evaluating based on demand. We operate on a scalable model to remain agile and flexible in our strategy,” said Mussad Al Muhaidib, board member of the Al Muhaidib Group. In October 2022, the company partnered with lifestyle destination developer Ajdan Real Estate Development Company to develop and market the $66.5-million Bayfront project in Al Khobar Corniche, which includes Saudi Arabia’s first Blue-Flag-certified beach, restaurants and recreational features.

Another family-run conglomerate driving economic development in Saudi Arabia is the Bugshan Group, which comprises 17 companies from the real estate, healthcare and grooming sectors. “Sitting down and having a dialogue with the public sector and identifying their targets is very important,” said Fares Bugshan, CEO of Bugshan Investments, the investment arm of the Bugshan Group. “The government is making these targets commercially viable by assuming lots of costs that the private sector would not be likely to assume. Dialogue and collaboration are key.” The group recently backed local food tech startup Matbakhi, which raised $2.3 million in its pre-seed funding round in January 2023. The startup operates five cloud kitchens to help local food and beverage entities create chef-driven menus and branding.

One major hurdle facing national champions in Saudi Arabia is availability of talent, particularly in new industries outside of the country’s core oil sector. With a median age of just 29 years, Saudi Arabia has a young and growing populace that will be relied upon to guarantee prosperity in years to come. Saudi Arabia’s leading companies are calling the upcoming generation to get involved in new sectors. “Acquiring talent is one of the major challenges in any business, whether it's a growing business or a startup,”said Al Muhaidib. “Talent is the most precious asset that people struggle to find and it’s a challenging endeavor.” Companies like Gasco are investing significantly in training the country’s next industrial leaders. “Even if you have the best system in the world, the resources and finances, the right people are still the essential component,” said Bin Sulaiman. “Gasco is investing significantly in training and development. Today we invest four times what we used to in the last 60 years on training.” The Helicopter Company has a similar perspective. “To support the long term industry, we are investing in the future and we take about 50 people per year – a mix of future pilots and technicians – and send them overseas to be trained,” Martinez said. “A new generation of Saudi talent must be mentored and developed internally.”

Movers & Shakers

Sheikh Mohammed Alajlan

Vice Chairman of Ajlan & Bros Holding Company

Aligning with the vision

Prominent family-owned conglomerate Ajlan & Bros Holding Company has planned its diversification strategy to align with the objectives of Saudi Arabia’s Vision 2030. Vice Chairman Sheikh Mohammed Alajlan sees the dynamic strategy as a golden moment for both national and international investment.

“The Saudi Arabian government is currently keen on progressing industrial development very quickly. Our challenge as private companies is to be even faster.”

Sheikh Mohammed Alajlan

-

read full interview... -

How has Ajlan & Bros Holding Company transformed from retail to

one of Saudi Arabia’s largest diversified conglomerates?

We first began in textiles in 1979 – a segment where we remain a dominant player in the Middle East – and moved into real estate, becoming one of the largest real estate companies in Saudi Arabia with more than $15 billion in land either primed for sale or sold. When the Vision 2030 initiative was launched in 2016, we understood this was the future. If one is not aligned with this initiative, one will be left behind and forgotten. We started our investment arm in the same year and developed businesses in all sectors mentioned in the strategy – some in partnerships with companies from the United States, Europe, Asia and other parts of the world. The company now invests directly and indirectly in 25 countries around the world. We still consider ourselves to be setting up the main pillars of the group to develop and prosper.

-

How is Vision 2030 changing both the business and physical

landscape of Saudi Arabia?

Saudi Arabia is already the gateway to the Middle East and North Africa region. Our country has a large area of 830,000 square miles. Developing an entire nation is akin to having a large portfolio of developments, projects and programs. HRH Crown Prince Mohammed bin Salman Al Saud has established royal commissions and 11 companies to oversee this new development, which will take time. Tourism and logistics are taking huge leaps forward, with perhaps logistics being the priority.

The Vision 2030 initiative is in full swing. Already one can see the development with their own eyes with Diriyah Gate, NEOM, Amaala, the Red Sea Project, Sindalah island, King Salman Park, work by the Royal Commission of AlUla and improvement of Mecca city and holy sites. We can see industrial growth in Jeddah and companies being established in Khafji in the eastern region and Tabuk in the northern region. We at Ajlan & Bros Holding Company are aligned with all sectors mentioned in the Vision 2030 strategy as it represents a huge market; we are actively working to increase our market share.

The real gross domestic product of the Kingdom of Saudi Arabia rose 8.7% year-on-year in 2022 to reach more than $1 trillion, the highest annual growth among G20 countries. This remarkable development exceeded the expectations of many economists and international organizations. Saudi Arabia's policies to support the national economy – guided by Vision 2030 – have yielded significant results in the past year, contributing to the diversification and liberalization of the Kingdom’s resources and creating a thriving environment for economic activities in all sectors. -

How significant are relations between the United States and

Saudi Arabia for the Middle Eastern nation’s economic

development?

The United States and Saudi Arabia enjoy a strong economic relationship. The United States is Saudi Arabia’s second largest trading partner, and Saudi Arabia is one of the United States’ largest trading partners in the Middle East. The United States and Saudi Arabia have signed a trade investment framework agreement and Ajlan & Bros Holding Company has been investing in the US real estate and equities markets for more than 15 years. Through Vision 2030, Saudi Arabia laid out plans to diversify the economy, including through increased trade and investment with the United States and other countries. This led to Ajlan & Bros Holding Company recently signing billion-dollar partnerships with American companies Solar Edge and Lightbeam.

-

What advances is Ajlan & Bros Holding Company making into the

financial services sector?

We have two lines of business in the segment. The first is a partnership with QNB Group, one of the largest banks in the Middle East and North Africa region. It has state-of-the-art technology that we are developing in Saudi Arabia. We are currently finalizing our official documents and licenses with the Saudi Central Bank. Our other line of business is a fintech company that we established from scratch called Tiqmo that handles digital payments. We established it in partnership with SwiftPass, a giant fintech company dedicated to providing mobile payment solutions. Another noteworthy collaboration is with Linklogis, a leading provider of supply chain finance technology solutions. Both parties are collaborating to establish a local company in Riyadh to jointly develop supply chain finance services, promote the digital transformation of the financial industry and address common financing challenges for small and medium-sized enterprises in the region.

-

Can you give us a description of the newly formed SCOPA Defense

subsidiary?

The United States and Saudi Arabia have a longstanding security relationship. Saudi Arabia is the United States’ largest foreign military sales (FMS) customer, with more than $100 billion in active FMS cases. Through FMS, the United States has supported the three following key security assistance organizations in Saudi Arabia: Ministry of Defense, Saudi Arabian National Guard and Ministry of Interior.

Vision 2030 clearly stipulates that Saudi Arabia is aiming to localize 50% of its military expenditures by 2030, which is the main reason we entered this sector. Our subsidiary SCOPA Defense is registered in Saudi Arabia and with the Directorate of Defense Trade Controls in the United States. We have obtained licenses and approvals from the United States to work as a defense broker and develop the defense system. SCOPA aims to focus on co-operation with companies in the United States and European Union that follow certifications set by the North Atlantic Treaty Organization. All our projects are certified by the organization and follow its guidelines and procedures. We have a wide range of partnerships with prominent US defense companies. -

What industrial segments in Saudi Arabia represent the most

opportunities for foreign direct investment from the United

States and the rest of the world?

There are many key areas of investment currently available, including tourism and entertainment, healthcare and food and beverages. Equally, all aspects of the oil and gas value chain continue to represent good returns, from upstream to downstream segments – particularly in petrochemicals. Alternative energy sources also represent huge investment opportunities, such as solar, wind and water. Logistics is another important avenue that plays a major role in our lives today. Additionally, technology and infrastructure represent important areas of co-operation. We have a company, Sandsoft, that is focusing on gaming, which is an interesting segment for investment. We also have a burgeoning mining and metals sector in Saudi Arabia, with many opportunities for American and Western companies. The holding company will invest $13 billion in this sector with the National Industrial Development and Logistics Program and has already partnered with UK-headquartered Moxico Resources, Swiss precious metals refining company Valcambi and National Securities Exchange of Australia to establish a metal and mining stock exchange in Saudi Arabia.

Our partnerships are as internationally diverse as the sectors we cover. For example, we are partnered with Dussmann Group, a world-renowned facility management services provider headquartered in Berlin, Germany, through Dussmann-Ajlan & Bros. Dussmann Group is one of the world’s largest privately owned companies. It was established in 1963, employs more than 65,000 employees in 21 countries and has annual revenues of around $2.5 billion. They saw the opportunity to partner with us in Saudi Arabia. -

Why is now the time for investors to consider moving into the

Saudi Arabian market?

We now have a leader who has made us believe he will change the country. The Saudi Arabian government is currently keen on progressing industrial development very quickly. Our challenge as private companies is to be even faster. To this end we have created international consortiums to participate in public private partnerships and privatization initiatives, such as the acquisition of Jubail 3B for $800 million with French company Engie and the acquisition of Second Milling Company in conjunction with international partners for $600 million.

Today there are many unique opportunities in all fields of business in Saudi Arabia. The Ministry of Investment has flung its doors wide open, and the private sector is highly willing to accommodate anyone who would like to come and invest. There are funds to support investors entering Saudi Arabia just as there are for local Saudi companies; no distinction is made. It is the ideal time for investors to enter the market.

-

How has Ajlan & Bros Holding Company transformed from retail to

one of Saudi Arabia’s largest diversified conglomerates?

Robert Wilt

CEO of Ma'aden

Partnering to leverage Saudi Arabia’s $1.3 trillion mineral potential

Robert Wilt, CEO, Saudi Arabian Mining Company (Ma’aden) talks about the company’s growth from humble beginnings to becoming a key player in Saudi Arabia’s Vision 2030 national transformation program, including recent international partnerships it has created to transform Saudi Arabia into a regional mining hub. He also outlines the extractive sector’s significance in both diversifying the local economy and supporting the global energy transition.

"It is unbelievable what is going on in Saudi Arabia; whether you are interested in mining, technology, tourism, sports, entertainment or finance, this place is on the move."

Robert Wilt

-

read full interview... -

Can you give our readers an overview of the company’s

beginnings?

Ma’aden is 25 years old with humble beginnings at the Ministry of Petroleum and Energy's office. At the time the Kingdom was almost exclusively focused on developing oil and gas resources. There were previously some forays with United States Geological Survey – mostly related to oil and gas –and local gold mining activities. However, no one was taking advantage of other mineral resources such as phosphates until 2007 when we established our first joint venture. We then immediately moved onto aluminum. In reality, the company is only about 13 years old in terms of significant growth and investment. Since then, we have become the world's second largest exporter of phosphates and now have the world’s lowest cost, fully integrated aluminum chain.

-

What does Saudi Arabia’s new focus on the local mining industry

mean for Ma’aden?

Under the Kingdom’s Vision 2030, we are diversifying beyond oil and gas. We have some natural advantages such as tourism and mining that have historically been underdeveloped. Estimates indicate that there is $1.3 trillion worth of mineral resources in the Kingdom. Ma’aden and the Ministry of Industry and Mineral Resources are currently working to develop that, and in the process, attracting some of the world's best exploration and mining companies.

Our basic mandate is to develop the third pillar of the Saudi economy. Under its diversification strategy, the Kingdom wants to develop a significant steel industry for shipbuilding and the Kingdom’s mega projects; an electric vehicle industry; and a high-tech industry. These segments all require a portfolio of minerals and metals, which is why building a significant mining industry is imperative.

We are benefiting from a new mining law and the government’s investment in geological surveys. The mining law is designed to attract foreign direct investment (FDI) into the mining sector and benefits Ma’aden because we are the natural partner of choice for FDI given our scale and scope. We know the stakeholders and the landscape, and we have done most of the legwork. There is a vast exploration program being undertaking by the Kingdom focusing on copper, gold, nickel, zinc and uranium. We are looking to bring these resources on stream quickly, through partnerships and on our own.

It is unbelievable what is going on in Saudi Arabia; whether you are interested in mining, technology, tourism, sports, entertainment or finance, this place is on the move. It is an amazing honor to be here, not only to have a front row seat to history being made, but also be able to play an active part in this transformation. -

What current international partnerships has Ma’aden made to make

Saudi Arabia a minerals powerhouse?

In our early days, we partnered with US-based global leaders such as Mosaic and Alcoa. We have a joint venture with Mosaic to extract phosphate at our Wa’ad Al Shamal complex and develop it into fertilizer products for global agriculture customers. We also have a long-standing partnership with Alcoa in the aluminum production complex in Ras Al Khair Industrial City, which is the world’s first fully integrated high efficiency aluminum production complex.

In addition, we have a joint venture with Canada’s Barrick Gold Corporation to operate Jabal Sayid mine, the only copper mine in the Kingdom. We have recently expanded that partnership to expand into additional exploration license areas with the goal of building a significant copper hub in Saudi Arabia.

We also recently agreed to buy 9.9% of US-based Ivanhoe Electric and form an exploration joint venture in the Kingdom. Ivanhoe Electric was founded by renowned miner Robert Friedland and houses the proprietary Typhoon technology. This technology will enable us to accelerate our exploration efforts by six times, and de-risk and advance the development of a significant exploration hub in the Kingdom. -

What plans does Ma’aden have to expand its current phosphate

production?

In 2009, we established the first phosphate company in the Kingdom. Currently, we are the world's second largest exporter of phosphate fertilizers. As global demand for phosphates continues to grow, only a few companies are capable of meeting production needs through expansion projects – and we are one of them. We currently produce around 6 million tons of phosphate fertilizer per year and plan on growing production by 3 million tons per year through a project we are calling Phosphate 3. Worley is our engineering procurement and contract manager for the development, and we plan on reaching full production by 2026 / 2027.

-

What are the main goals of Ma’aden and the Public Investment

Fund’s recent joint venture?

Our joint venture with the Public Investment Fund is aimed at expanding our footprint into global supply chains to source minerals and metals essential to downstream development of the Kingdom’s industrial economy. We plan to acquire minority equity investments in global mines, assets and companies and secure off-take agreements to support the development of downstream industries in Saudi. We are initially looking for iron ore, nickel, copper and lithium to drive the industries of the future.

-

What is Ma’aden’s long-term strategy?

We already have a significant footprint. We are responsible for around 6,800 direct employees, but there are 45,000 people working around or in adjacent industries to process our minerals and metals. This will grow as we continue the buildout of our phosphate industry. We are also poised to take advantage of our long-life bauxite mines and competitive energy, which are both perfect ingredients for aluminum expansion. And we have at least two more promising gold projects in pre-feasibility stages that could come online in the next five years.

We will continue to grow and expand along our current verticals – phosphate, aluminum, and gold and base metals. We will increase volumes across all our major lines and are simultaneously undergoing a major cost takeout initiative. We are looking for margin expansion across the board. Our overall strategy follows four distinct pillars. The first is to develop the mineral endowment of the Kingdom with exploration and growth. We have a great asset base. We will make it bigger. The second is to drive the productivity of our assets; we need to continue to sweat these assets, make them more productive and throw off cash for future investment. The third is value creation through innovation and enabling future segments, whether it be green fertilizers or green aluminum. The last is to be a role model for environmental, social and corporate governance (ESG). Focusing on ESG is not simply a way of operating; we view this as an opportunity to address global issues and challenges, distinguish ourselves and give ourselves a competitive advantage. The Kingdom is driving an ESG agenda, and as the national mining champion we are aiming to become an ESG role model for local industry. -

How is the global energy transition driving focus on the mining

industry, and what efforts is Ma’aden making to cut its carbon

footprint?

The world requires the mining industry to achieve its energy transition and move towards green energy. However, to do so we need to double the amount of copper we are mining in the next decade and produce five times as much aluminum in the next 15 years. Saudi Arabia is significant in this transformation as it sits at the center of the world between Asia, Africa and Europe. The Kingdom is a perfect logistics hub that is endowed with significant yet-to-be-explored mineral potential.

A key component of our strategy is decarbonization. The Kingdom is well positioned for carbon capture, utilization and storage, with potential for carbon capture and sequestration all up and down the eastern coast. Additionally, we have vast amounts of wind and sunshine and are a great home for renewables. In terms of environmental focuses, groundwater usage is a major concern here in the Kingdom as much of the country is desert; we must be cognizant and remain good stewards of our water resources.

Ma’aden is committed to becoming carbon neutral by 2050 and has developed a roadmap beginning in 2022 with checkpoints and milestones along the way. We have already taken out 300,000 tons of carbon from our emissions through a circular economy agreement with a food and beverage company. We are currently the world's largest exporter of blue ammonia and have recently signed a series of agreements with suppliers from the world’s largest markets to provide over 138,000 tons of blue ammonia products. We have planted 3 million trees so far with the commitment to plant 20 million as part of the Saudi Green Initiative. We are already utilizing renewable energy to fuel our newest gold mine. This ESG roadmap will continue to accelerate over the next decade. -

What is the company doing to promote other ESG activities such

as job growth, equality and good governance?