The Philippines

THE BUSINESS OF PLEASURE

overview

The Philipines

SUSTAINED GROWTH AND SOUND FUNDAMENTALS ARE PROMPTING INVESTORS TO LOOK ANEW AT THE PHILIPPINES. WHAT’S MORE, ECONOMIC EXPANSION IS SEEMINGLY IMMUNE TO THE COUNTRY’S LIVELY POLITICS. IS LASTING PROSPERITY NOW A REALITY?

articles & interviews

- All

- tourism

- infrastructure

- healthcare

- interviews

Tourism

The business of pleasure

Infrastructure

Setting the foundations

Healtcare

The pursuit of wellness

Oscar M. Lopez

In pursuit of excellence

Efraim C. Genuino

Reinventing the entertainment business

Teresita Sy-Coson

Entrepreneurial spirit

Energy

Seeking solutions

Tourism

Record tourist arrivals owe much to savvy marketing. A shift in focus toward lucrative niche markets and promotion closer to home have paid dividends. And multibillion-dollar developments hint at the sector's potential.

A shift in strategy from concentrating on Western markets to paying more attention to those closer to home has yielded dividends. “We focused 90% of our energy and resources to conquer two important markets – mainland China and Korea,” says Durano. That led to a sharp growth in visitors from both places, with South Korea last year shooting to the top spot of tourist arrivals, overtaking the U.S. The other top markets included Japan at number three, followed by China, Australia, Tai- wan, Hong Kong, Singapore, Canada and the U.K. Mainland Chinese arrivals rose 18% last year, with Scandinavia and India also showing double-digit gains. The biggest increase in tourist numbers was from Russia, with arrivals up 128%, albeit from a low base.

“The pace of growth of foreign arrivals is now highly dependent on the pace of our infrastructure development,” Durano acknowledges. “Completing big projects requires time.”

He says there are currently over $2 billion in hotel and resort initiatives underway across the country, part of a total estimated $5.6 billion in tourism-related investments. The sector already employs some four million people. Many hotels in Manila have also been upgrading their facilities to complement the government’s drive to sharpen its promotion efforts in established markets in North America and Europe.

-

read more...

The InterContinental Manila, for nearly four decades a five-star favorite among locals as well as business travelers who choose to stay in the fashionable Makati financial district, recently completed a refurbishment of its guest rooms, restaurants and public areas. The InterContinental Hotels Group, which has two other properties in the city under the Crowne Plaza and Holiday Inn brands, “is exploring the possibility of operating more hotels in the Philippines, under any of the brands in its portfolio,” says Christian Pirodon, the InterCon Manila’s General Manager. “There is a big demand for more hotel rooms, so the future looks bright.” The development of the tourist industry is essential for the Philippines to be globally competitive and to fully regain momentum. Now that the economy is performing well, the opportunity to sustain growth cannot be missed, he argues. “For us to recover economically, the answer is tourism,” says Efraim C. Genuino, PAGCOR’s Chairman and CEO. Secretary Durano agrees but is keen to maintain his successful strategy of targeting lucrative niches, rather than resorting to a mass-market approach.

In the U.S., for example, where perennial travel advisories warn visitors of potential hazards in the Philippines, which limits growth in the mainstream travel market, the DOT has continued to target mainly Filipino-Americans, the second-largest Asian ethnic group in the U.S., who make up about 1.5% of the total U.S. population. And that focus has proved successful. Today, some 50% of arrivals from the U.S. have roots in the Philippines. In Western Europe, meanwhile, the Philippines has been highly successful in promoting itself as a destination for scuba diving enthusiasts. “To attain the numbers we desire, we don’t need the entire world to come to the Philippines,” says Durano. Of course, as the Philippines succeeds in attracting more visitors, it will have more to prove. That will mean having to increase investment, upgrade facilities and services further, and strategically target more markets. Concludes Durano: “The challenge is definitely bigger now. We have made it this far and now we have to take the next step.”

BY JOSE MAURICIO

Movers & Shakers

Oscar M. Lopez

CEO if the Lopez Group of Companies

In pursuit of excellence

“I am obsessed with longevity, not only for myself but also for my company,”

says Oscar M. Lopez, CEO of the Lopez Group of Companies, one of the most diverse and successful conglomerates in the Philippines.

At nearly 78, Lopez just returned from climbing Mt. Arayat in the province of Pampanga, and to set a good example for his employees he hardly ever uses the elevator to make it to his top- floor office preferring the “stairway to wellness” instead.

“When I picked up the chairmanship of this group from my brother in 1999, I knew I had to keep myself in perfect shape in order to handle all the work that was going to come my way,”

says Lopez.

With businesses ranging from energy, tollways and media to telecoms, real estate, and manufacturing, among others, few companies in the Philippines have shaped the country's corporate landscape more than the Lopez Group.

Its companies, such as First Philippine Holdings, Benpres Holdings and Rockwell Land, are top performing enterprises in their respective sectors, and its international partners are some of the leading global names.

“Excellence is a fundamental value upon which we have built our group of companies and one which will assure its existence beyond the current management,”

says Lopez.

“While my father emphasized work ethic and entrepreneurship, building on excellence has been my personal contribution to the values of the company.”

Lopez also stresses unity between employees and management as a fundamental value to achieving success:

“In our group, everybody knows what our objectives are and how much money we are sup- posed to make at the end of the year. Applying this transparency works like an energizer for the whole organization,”

he says.

Few concepts have influenced Lopez’s thinking more than Jim Collins and Jerry I. Porras’ book, Built to Last, detailing how a select group of great companies managed to stay ahead of their competitors over the greatest part of the last century.

“I strongly believe that a manager has to be a clock maker more than just a time teller,”

says Lopez, paraphrasing one of the main pillars of the book. According to this thinking, a company should not rely on a great idea or a charismatic, visionary leader – “time telling” – but more on building a corporation that can prosper through multiple product life cycles and taking an architectural approach to establishing its main traits – “clock making.”

With this concept in mind, Lopez has built a company that can act as a role model for a whole new class of Filipino entrepreneurs who are about to enter the global market.

PAGCOR's Wanders

show has brought a touch of Las Vegas to the capital.

Efraim C. Genuino

Chairman and Chief Executive of PAGCOR

Reinventing the entertainment business

Many would assume that to run one of the biggest casino operations in Southeast Asia takes a passion for gambling and risk-taking. But Efraim C. Genuino, Chairman and Chief Executive of state-owned gaming operator PAGCOR, is a cool-headed manager who prefers the calm of his office to the crowded floors of PAGCOR’s casinos.

Genuino, a former private businessman with little prior experience in the gaming industry, began his term at the helm of PAGCOR with an unusual approach:

“When I was appointed Chairman, I went for a long trip abroad to visit a number of casinos in the United States and Europe.

My goal was to find a formula to overhaul the Philippine gaming industry and the answer was clearly Las Vegas,”

he says.

With 75% of Sin City’s income deriving from non-gaming activities such as hotels, restaurants and entertainment, it was clear to Genuino that this model would be successful in the Philippines, a country whose population is known for its joie de vivre.

“Las Vegas has now become a family-oriented destination,” he explains “and we didn’t have to reinvent the wheel to make it work over here.”

-

read more...

With this concept in mind, which goes back to the true meaning of the word casino – a small villa on the ground of a larger Italian palazzo where sports and arts performances used to take place – Genuino began implementing PAGCOR’s fundamental switch from a simple gaming operator into a wider organization providing entertainment and boosting the tourism industry. “We need tourism to recover economically in the Philippines, more than any other sector,” says Genuino. Although he is aware that the gaming industry has raised brows in certain sectors of Philippine society, he is keen to show the benefits it is bringing: “I know that the Church is against gaming, but it important that it sees our shift from gaming to entertainment and tourism, as we are creating wealth and jobs in the process.”

PAGCOR’s show Wanders, for instance, places the best of Filipino dancers and singers with Chinese acrobats and Russian ballet dancers in a unique melange of international artists comparable to the Cirque de Soleil’s eclectic mix. “It is a combination of action, drama, acrobats and music,” explains Genuino, who worked on conceptualizing the show right from the beginning before passing it to professional directors. “They say that Filipinos are the best entertainers in Asia and this show proves that to be true.” But Wanders represents only the tip of the iceberg of Genuino’s business acumen. The construction of Manila Bay Integrated City, a wholly integrated tourism and entertainment zone boasting an impressive list of features ranging from shopping centers, golf courses, hotels, restaurants and residential villages, among others, is the gem of Genuino’s vision. “Because of the location, the people and facilities that can be developed over here, the Philippines has a strategic edge com- pared to other places in the region for such an investment,” says Genuino. “Although Macau and Singapore can bank on a wealthier upper middle class which may even reach 50% of the population, the Philippines boasts 90 million people, 15% of which are considered affluent. By doing the math it is quite obvious that we can count on a much larger client base.”

The construction of Manila Bay Integrated City estimated to cost initially between $6 billion and $7 billion and investors are waiting impatiently for it to become a reality. A few years ago, Las Vegas’ Mayor, Oscar B. Good- man, made Genuino an honorary citizen of the city for his outstanding contribution to the gaming industry, but soon he may go down in his- tory as the founder of one the most impressive entertainment complexes in Southeast Asia.BY MARCO VENDITTI

www.wowphilippines.com

www.experiencephilippines.com

Infrastructure

Record economic growth and rising investor confidence are threatened by an infrastructure that is not yet fit for purpose. A massive government spending program will create the basic for sustained economic expansion.

Fueled by a remarkable confluence of factors, the Philippine construction industry is enjoying a powerful resurgence after almost a decade of doldrums. Government infrastructure spending, inward investment from overseas Filipino workers (OFWs), and a robust business outsourcing industry are driving the construction boom, while growth in tourism and retail spending are supporting its continuation.

“The real estate business is booming right now because of the economic and political situations,”

says Jose L. Acuzar, Chairman of New San Jose Builders Inc., a Manila-based developer that specializes in infrastructure and residential projects.

“My feeling is that there is a big market for what we do.”

The Philippines has entered an era of political stability which has boosted confidence in the economy.

The government has played a direct role in stimulating construction, and the economy, by pouring money into roads, bridges, airports, and rails as part of a $20-billion, countrywide infrastructure-development program.

More than 20 airport and seaport upgrades are included in the plan, along with a dozen or so major bridge and highway works and a handful of rail projects, including a high-profile $130-million light-rail system for Manila.

Some of the most ambitious projects are in the south, including Mindanao, where a 70-kilometer highway that includes three large bridges is underway between Butuan City and Las Nieves.

The Mindanao projects will improve both the business climate and the quality of life in one of the archipelago’s poorest regions.

-

read more...

“The recent boom in property development is due to increased consumer confidence, and that has also made the country inviting to foreign investors.”

The continuing strength of the country’s business process outsourcing (BPO) industry, especially call centers and back-office support, has also amplified the demand for construction, as BPO operators typically require large amounts of office space. According to property consultants CB Richard Ellis, more than 730,000 square meters of new BPO space will open this year in Metro Manila alone. At the same time, overseas Filipinos are driving the construction of affordable housing. Residential property at home is a favored investment, escalating the need for condo towers. Meanwhile, the rising popularity of the Philippines as a tourist destination has encouraged developers to build hotels and related infrastructure such as convention centers, while steady growth in consumer spending has raised the demand for shopping malls and other retail space.

“The recent boom in property development is due to increased consumer confidence, and that has also made the country inviting to foreign investors,”

says Manuel S. Mendoza, President and CEO of Monolith Construction and Development Corp. (MCDC), based in Quezon City, Manila.

A few mixed-use, mall-retail-office projects are underway beyond the capital, notably in Davao City and Cebu, but most are still to be found in Metro Manila. Developers such as Ayala Land, among the country’s largest, and Megaworld are involved in the construction of Bonifacio Global City, a former U.S. military base at the heart of the capital. Megaworld is developing the 50-hectare McKinley Hill complex there, a project that will encompass residential towers, plus office and retail space. The same firm’s 9,000- unit, 20-tower Manhattan Garden City development in Quezon City is the largest condominium project in the country. Quezon City will also be the site of the Araneta Group’s Cyber Park, a 10- building complex devoted exclusively to the BPO industry, and Ayala Land’s own 37-hectare BPO complex. To meet the demand for such varied construction, developers have expanded their areas of expertise.

MCDC, for example, once concentrated on high-rise condo and office projects, mostly in Metro Manila. But after the crisis, the company moved into the mall-building business, and has since built more than 20, including part of the SM Mall of Asia in Pasay City, one of the world’s biggest. “The cost of building shopping malls is much lower than high- rise condos,” says Mendoza, “and it takes less time to build them, so there is a faster and greater return on investment.”

MCDC remains active in other sectors, too: it recently completed the state- of-the-art SMX Convention Center at the Mall of Asia and is building call centers on a large scale. Like other developers, it is busy in Bonifacio Global City, a 4,440- hectare site that will become Asia’s newest multi-use urban center, complete with offices, banks, residences, retail space, and schools. Developer DDT Konstract Inc., which is building BPO projects around the country, along with high-rises, churches, and malls, also wants to ride the economic tide into new sectors. “I want to move into infrastructure,” says Danilo D. Tamayo, the firm’s President. “It’s a significant market.” Similarly, New San Jose Builders, which was launched in 1986 as a small subcontractor building houses, roads and other modest projects, has taken advantage of the robust market to move into a growth area: developing and building residential towers. And Rey L. Vergara, the firm’s President, has targeted a significant market niche.

“If I were to classify our markets, we are dealing with the middle and the lower- middle income groups,”

Vergara says. “These groups appreciate the lower prices of the condos we sell, where value is given precedence over everything else. We say value because we are priced 30% to 40% lower than our competitors.”

The company is also active in Fort Bonifacio, where it plans to build residential towers for middle-income buyers. At the same time, it has expanded its infra- structure business into larger highway projects, such as the South Luzon Expressway.

In spite of the current strength of the industry, there are clouds on the horizon. Costs have risen sharply, especially for essential materials like steel, oil and concrete. “The cost of steel has almost tripled, and this has been a rough experience for the company,” says Tamayo of DDT Konstract. “But I think we can weather it. The challenge is really how to lock in good prices for these major materials.” There are also signs that demand from end users may be slowing. The peso has risen in value more than 20% against the U.S. dollar over the past three years, threatening the inflow of cash from overseas workers, while an economic slowdown in the U.S. or Europe would dampen the market for business outsourcing and tourism.

Yet a significant slowdown in the market is still several years away: Acuzar, New San Jose’s Chairman, says five years, while Mendoza of MCDC says three. However, New San Jose’s Vergara is more optimistic.“We have a huge market in the Philippines, and for as long as that huge market is here –and I think it will be for 20 to 30 more years – we can take advantage of that strength.”

BY BRENT HANNON

Real estate: the only way is up

Powered by a booming economy and rising consumer confidence, property values and rental rates are rising steadily in the Philippines.

Given the strength of the economy, the real estate boom looks set to continue.

“All the legs that it stands on are quite stable,” says Frederick D. Go, President and CEO of Robinsons Land Corp., one of the country’s largest property developers.

“The trend is toward the strengthening of these factors: foreign remittances, business process outsourcing, the lowering of interest rates, and availability of mortgage financing.

I believe that even if one leg goes, the other three will remain strong.”

While the rising economy has lifted all property, the demand drivers are distinct for each sector. Residential purchases are strongly supported by funds remitted from abroad.

“The foreign demand is almost entirely from overseas Filipinos,” says Matthew Montagu-Pollock, Publisher of Global Property Guide, an online data- base that analyzes property statistics.

Residential and office rental demand, on the other hand, is fueled in part by expatriates, many employed in the country’s fast-growing outsourcing industry.

And retail property has seen broad-based demand, driven by remittances and expatriate spending, as well as domestic consumer confidence.

-

read more...

Manila - Philippines. Low interest rates are also prompting growth in all sectors, says Go. “On the corporate side, lower rates result in more investments and more opportunities,” he says. “On the retail side, it helps spur more purchases because lower interest rates make payments more affordable.” The property boom is apparent to any visitor. Construction sites are common, especially in fashionable Manila neighborhoods, with an abundance of condos, landed homes, office blocks, and malls being built or renovated.

“The pie is getting bigger, more people are buying real estate, more money is flowing in from overseas, and more BPO companies are setting up shop, but the supply side is also growing,”

he says. “Everybody who owns a piece of land thinks he can do real estate. And that’s probably our [greatest] concern, since some people don’t have the required experience.” As one of the country’s most experienced developers, Robinsons is active on five fronts: malls, hotels, offices, condominiums, and landed homes. In the current climate, the company must work to distinguish itself from the new arrivals. “The market is becoming more dynamic and competitive, and our company is putting more planning and pluses into all projects,” says Go. Despite the soaring values, condos remain comparatively inexpensive in Manila, according to Global Property Guide.

Foreigners are free to buy condominiums in the Philippines but Go has this advice for would-be investors: buy quality. “It’s best for them to do their own research,” he says. “And buy properties only from reputable companies.”BY BRENT HANNON

www.sminvestments.com

Teresita Sy-Coson

Vice-Chairman of SM Investments Corp.

Entrepreneurial spirit

Teresita Sy, or “Tessie” as friends and colleagues call her, belongs to a class of entrepreneurs who are always at the cutting edge, despite an innate desire to operate behind the scenes.

“I believe that women in business can let other people take a prominent role, as long as they are able to achieve their ultimate goal,”

she says.

In a country where two women have been elected to the top office – including the current president, Gloria Macapagal-Arroyo – and Gabriela Silang, an 18th-century revolutionary leader, is considered a national hero, it’s no surprise that Sy quickly climbed the ladder of her family business.

Today, she is Vice-Chairman of SM Investments Corp. (SM).

Born the first daughter of businessman Henry Sy, widely credited with having reinvented Philippine retail in the post-World War II period, she grew up in an environment conducive to business.

“I never thought of becoming anything other than a business- woman, because I didn’t know any other world,”

she says.

Today, Sy leads an empire that employs 27,000 people, with businesses ranging from shopping-mall development and management (SM Prime Holdings Inc.); retail merchandising (SM Department stores); financial services (BDO and China Banking Corp.); real estate development; and tourism.

“We never thought we were going to become such a huge con- glomerate, we just kept reinvesting our profits into the business. A process which lasted over three decades,”

she says.

Masterminding the merger between SM’s fully owned Banco de Oro and Equitable PCI Bank, where the group was a major investor, helped earn Sy an Asian Banker Award for Women in Financial Services.

“I guess they felt pity for me as I had to overcome two years of complexities and problems to merge these two institutions,”

she says ironically.

The rebranded BDO has emerged as the country’s second-largest bank, combining strong corporate lending with Equitable’s grip on the retail segment of the market.

“We decided to merge these two institutions because BDO had always wanted to expand nationwide and be on a par with the industry’s current leaders,”

says Sy, though she stresses that to become the No. 1 bank in the Philippines is not her main objective.

“Our main goal is to reach as many clients as possible since SM has always been a customer-oriented group.”

Providing the best-possible services to a wide platform of customers is clearly in Sy’s genes.

“Our macroeconomic indicators are very good at the moment, but I do feel that too much attention is still drawn into politics instead of business.

That happens at a regional as well as a national level,”

she says.

Healthcare

STATE-OF-THE-ART HEALTH-CARE facilities offer The Philippines an advantage in the global market for medical tourism, and WORLD-CLASS treatment for domestic user.

The pursuit of wellness

The Philippines is building an international reputation for the excellence of its health-care facilities and is increasingly attracting “medical tourists” from around the world. Medical tourism is a significant growth market. Last year, some 750,000 Americans traveled abroad for medical care and this number is expected to increase. Health care is set to become increasingly global as practitioners, patients and funding migrate.

“Medical tourism is an emerging phenomenon in the health-care industry,”

said Paul Keckley, Executive Director of Deloitte’s Center for Health Solutions.

Although the Philippines has entered the medical-tourism market later than some of its Asian neighbors – Singapore, India and Thailand are well established – the sector is expected to grow rapidly.

The government has set up a private-public initiative, the Philippines Medical Tourism Program, to attract overseas clients who can combine their medical needs with a vacation.

-

read more...

“We have a medical-tourism program in place so that foreigners can come here for the quality of our services and extremely affordable health care,” says Francisco T. Duque, Secretary of Health. “Our doctors are world class, and many have been educated at the best training institutions in the world.”

Keckley agrees that cost is a key factor: “The impact of dramatically rising U.S. health-care costs is felt in every household and by every company. Even consumers with employer-sponsored health insurance are increasingly considering medical tourism as a viable care option,” he says. “Medical care [in some countries] can cost as little as 10% of the cost of comparable care in the U.S.”

For consumers, he says, “the safety and quality of the care available in many offshore settings is no longer an issue as organizations including Joint Commission International [JCI – the largest accreditor of health organizations in the U.S.] are accrediting these facilities.”

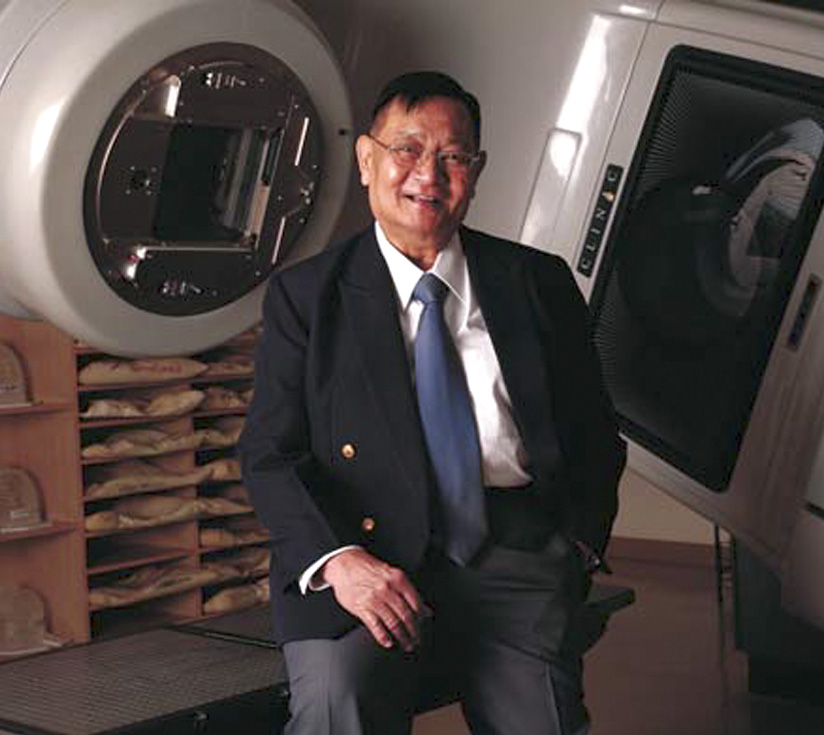

Among the Philippine institutions attracting clients from abroad is The Medical City, a private, tertiary-care hospital with more than 40 years’ experience. It is based in Manila and has full JCI accreditation. With impressive new facilities, The Medical City has centers of excellence in cardiovascular, cancer, neuroscience and regenerative medicine and says that its philosophy is to treat the patient as “an equal, informed and empowered partner in the pursuit and preservation of health.”Dr. Alfredo R.A. Bengzon, President and CEO of The Medical City, says:

“We have a distinguished medical staff of some 1,000 physicians, all of whom are experienced, recognized and established experts in their various fields of specialization.”

He adds that many of the nursing staff have worked in some of the best medical facilities in the world and have brought that experience back to the Philippines. “A lot of people, when it comes to health and hospitals, think only about the technology. But the machines and instruments are only as good as the people behind them. We have state-of-the-art technology and great facilities, but what drives them is the people we employ.”

While Dr. Bengzon, a former Secretary of Health, takes pride in the international component of his business, he also considers The Medical City a referral center for hospitals across the Philippines. “Our desire and ability to service other hospitals is not simply about the delivery of health services. We also want to help them with management. We have developed all this experience, these talented people, and we want to share them.”

Cost is also a factor. “In Beverly Hills, a breast-augmentation procedure costs up to $12,000, here it costs $4,000.

While the Philippines is developing a presence as a provider of world-class medical care, it is also building a reputation abroad for cosmetic procedures. Dr. Victoria Belo, who is credited with enhancing the looks of a number of Filipino celebrities, is attracting clients from around the world, and in particular from the Middle East. Dr. Belo, who trained as a dermatologist, is Medical Director of the Belo Group, which has eight clinics in the Philippines. “I go abroad a lot to train with the best doctors in their fields, you can never stop learning, and then I bring that expertise back to the Philippines,” she says. What sets the Belo Group apart from other providers, she adds, is “the language, the technology, the care and the experience.”

Liposuction in the U.S. is between $5,000 and $7,000, here in the Philippines it is $3,000. And when people have had procedures, they can take a vacation at a spa and relax,” she says. Looking forward, Dr. Belo says her vision is for both her company, and her country, to be global leaders in medical tourism. “If we are leading, it is because we invest in what we do. There are machines that I have put to pasture because they are no longer the very best, but it’s expensive to be like that, especially in the Philippines,” she says.

“It is my dream to make the Philippines the [world] beauty capital.”

As well as attracting medical tourists, the Philippines is rapidly improving health care for its own people. The government has created “FOURmula One,” a policy to bring together the public and private health sectors with national agencies to implement health reforms and institute national health insurance.

“We are expanding our specialist hospitals with expertise in lung, heart, kidney, trauma, and children’s medicine, and we have begun upgrading many of our primary hospitals so that they are capable of man- aging and treating more difficult cases,” says Health Secretary Duque.

-

read more...

While national health insurance is growing, so too is the provision of company health-insurance schemes through American-style health management organizations (HMOs). Among them is Asalus Corp., which is popularly known as Intelli- Care, the brand name of its HMO business “Our mission is to lead, innovate, and trail- blaze a holistic approach to health-care management by consistently providing top quality, highly personalized health-care services that are easily available, accessible, and affordable,” says Mario M. Silos, Pres- ident of Asalus Corp. He explains that the company has forged strategic alliances and affiliations with a network of over 480 hospitals, clinics, diagnostic centers, and other medical institutions that are manned by more than 7,000 of the country’s most highly regarded physicians and medical specialists.

Asalus Corp. is expanding and moving beyond the major cities. The company plans to offer a nationwide service in the next five years. “Corporations are now moving into rural areas [as] they want to save money on urban rents, and that is playing to our strategy,” says Silos. “We put up the systems ahead of them.” IntelliCare now has more than 360,000 members and a client retention rate of over 90%. Silos says that within the next 10 years, it plans to have a million members.

Another organization with ambitious plans is Pascual Laboratories, a privately held pharmaceutical company that is now the second-largest domestic player in the sector. “We have consistently been one of the industry’s fastest- growing companies for the past decade,” says Abraham F. Pascual, Chairman of the Board. “We have achieved leadership in the OTC [over-the-counter] wound-remedy segment, in the locally produced herbal-medicine market, and in generics, as well as prominence in anti-infectives, anti-tuberculosis and vitamins segments.” Pascual Laboratories was set up by the current Chairman’s parents in 1946, and he says one advantage the company has over its competitors is “our name recognition and our relationships, which count a lot in Asia. We have developed relationships with the doctors, they know us, and they know what kind of company we are.”As well as producing generic pharmaceuticals under the Pharex brand, the company has moved into health supplements and herbal remedies. “We are now looking at the export market,” says Pascual. “We are looking at the ASEAN countries. We have a trade agreement with them, and they are trying to harmonize the requirements – as soon as that is done, we will be able to expand.” But Pascual won’t sanction expansion at all costs. “Our long term vision is to continue to do business the way that we do it now. It’s nice to make money, but how you make it is what is really important to me.”

BY HELEN JONES

18 years of word-class service

www.belomed.com

Energy

seeking solutions

SOARING OIL PRICES PROMPT AN AMBITIOUS PUSH TOWARD ENERGY INDEPENDENCE AND RENEWABLE ALTERNATIVES. LEADING PRIVATE PLAYERS PROVE THEIR GREEN CREDENTIALS.

Like many other countries reliant on imported energy, the Philippines has ambitious plans to achieve energy independence in the face of soaring commodity costs. But today the Philippines remains dependent on imported oil and coal, which together provide more than 70% of the archipelago’s energy needs. This reliance on imports has been hard on consumers forced to pay sky-high global prices but is creating new opportunities for the country’s private energy companies, which have seen their portfolios expand rapidly. The increased demand for energy brought about by a sustained economic boom, combined with the steep climb in oil prices, prompted the government to draw up the Philippines Energy Plan. It set ambitious targets that included not only energy self-sufficiency but establishing the Philippines as a global leader in sectors such as geothermal and wind-energy production.

-

read more...

The plan set an interim target of achieving 60% self-sufficiency through a combination of increased access to domestic oil and gas reserves, reduced coal imports, and the development of bio- fuels. The timeframe for the plan was subsequently extended to 2030. Domestic oil production, at 23,000 barrels per day (bpd), met just 7% of the country’s demand, but new fields due to come into production should push that contribution to 10%. The Department of Energy has also awarded a number of contracts for exploration, mainly in the Malampaya region that has both a natural- gas field and deep-sea oil deposits. Exploration and development of the area will be expensive but the rise in world oil prices has made it attractive, and the international majors are moving in. Chevron Texaco and Shell are already active in the area, and Exxon Mobil, the world’s biggest oil and gas producer, announced that it plans to drill exploration wells, if initial data proves positive. The growing demand for oil products has been good news for the Philippines’ largest petroleum-tankering and bulk logistics provider, Petrolift Inc. The company has long been a pioneer in the domestic tankering sector, being the first to introduce IACS-classed coastal tanker barges, the first to secure International Safety Management certification from the American Bureau of Shipping to operate oil tankers in the Philip- pines, and the first to introduce IACS-classed ocean-going double- hulled oil tankers, the largest in the Philippines. The introduction of three double-hulled tankers has sharply raised the company’s capacity to deliver oil products throughout the archipelago, and the bottom line. But it isn’t all about business. “[The ships are] more socially responsible and environ- mentally safe. We are very happy to expand, it’s very good for the company. But helping the environment is something you cannot put a value on,” says Lawrence N. Leonio, CEO of Petrolift, and member of a family that has been in marine-related businesses for four generations.

But helping the environment is something you cannot put a value on,” says Lawrence N. Leonio, CEO of Petrolift, and member of a family that has been in marine-related businesses for four generations. “Each time we reach a milestone like this, we also raise the quality in the industry and then it becomes the new standard.” Petrolift is not focused only on the Philippines, nor on oil. Leonio is keen to use the company’s leading position in domestic tankering to expand in the region. “Our strategy is to play the intra-country [market], the domestic shipping. We want to lever- age what we have in the Philippines and enter other Southeast Asian countries.” He is also excited about a recent move into the mining logistics business. “With [rising prices], everyone is looking at commodities. China is very hungry for metals, and fortunately the Philippines is very rich in natural resources. We expect a lot of demand in terms of mining logistics.” Oilink International, the largest independent oil company in the Philippines, has also seen business expand strongly, from humble beginnings. “We started in 1966 as a recycling plant. We collected used engine oil, refined it and used it as a lubricant. We pioneered the business of energy conservation and environ- mental protection when crude oil was still a few dollars,” says Chairman Paul Co. Following the deregulation of the oil industry in 1997, the company moved into retail, opening the first full-service gas station under the Unioil brand. It was also the first to open an oil import terminal, to reduce dependence on existing refineries. Diesel oil is the major product the company imports, supplying local public-transport networks and most of the independent gas-station chains. “We have long-term supply contracts [with] foreign refineries operating in the region,” Co explains. The company also manufactures, and retails lubricants having partnered with Japanese manufacturer, Idemitsu.

BY JOSE MAURICIO

Oilink is also a major supplier of asphalt to projects such as the Iloilo Airport and Subic/Clark Expressway. “We expect more infra- structure projects in the coming years,” Co says.

Co adds the rapid rise of oil prices, and the 20% appreciation of the peso, contributed to record profits for Oilink, and it is moving to take advantage of the buoyant market.

“Our strategy is to expand the reach of our service stations, and to encourage the independents we supply to follow suit,” he says. “We would also like to introduce better quality fuel oil to the market.

At present, when international vessels come to the Philippines, they usually carry enough fuel oil with them to go back to their port of origin because the prices and quality to be found here are not competitive.”

The company is also working toward a greater role for environmentally friendly energy sources. “We are required to put 1% of CME [coconut methyl ester] into diesel oil.

We have invested in a bio-diesel plant in Mindanao where coconut is readily available,” Co explains.

Flying V, the operator of more than 160 gas stations throughout the Philippines, was also born out of the deregulation of the oil industry in the late 1990s.

Conscious of the environment, Ramon F. Villavicencio, Flying V’s Chairman, is proud of the fact that his company was ahead of the government in introducing environmentally friendly fuels.

“We were the first to dispense bio-diesel through our stations, two years before the law mandated it,” Villavicencio says.

“For which we were recognized by the Department of Energy and given a Presidential Award for pioneering the commercialization of bio-fuels. We have strengthened our R&D efforts on plant sources like sorghum, jatropha, malunggay and the development of coco-ethanol.”

Although he describes Flying V as a fully integrated oil company whose infrastructure extends from the import terminal and storage depots to the dispensing pumps in its gas stations, Villavicencio knows renewable energy is the future.

“Fossil fuels will be depleted and going green is imperative. The global need to search for alternative energy sources and renewables applies equally to the Philippines.”

Together with its affiliates, Flying V’s activities also encompass depot and logistics operations, lubricants and asphalts manufacturing, and a distribution network complemented by barges and tanker trucks which supply its retail outlets and customers.

“The company has established its presence in all facets of the petroleum business,” Villavicencio says. “Flying V’s network strength puts it in an enviable position.”